|

FOB China

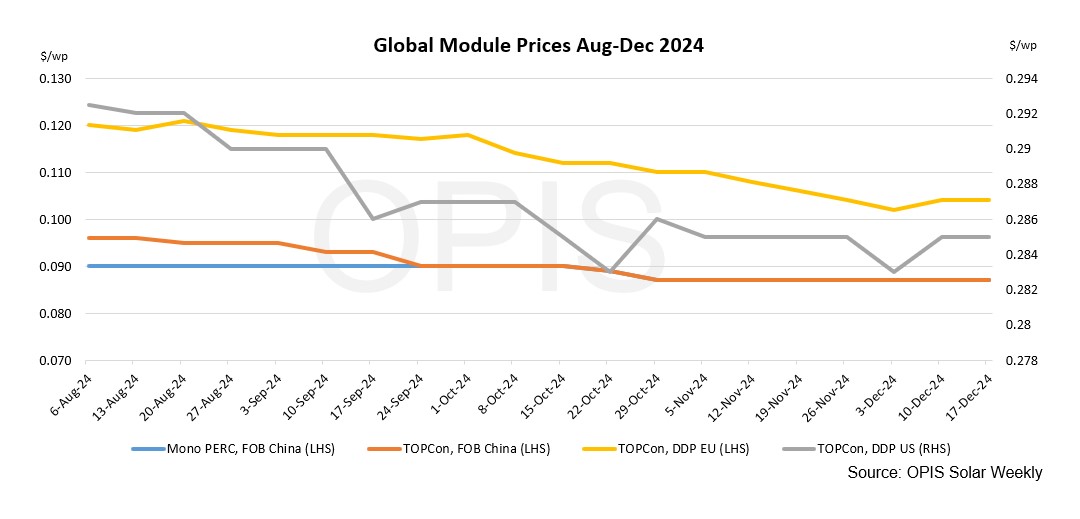

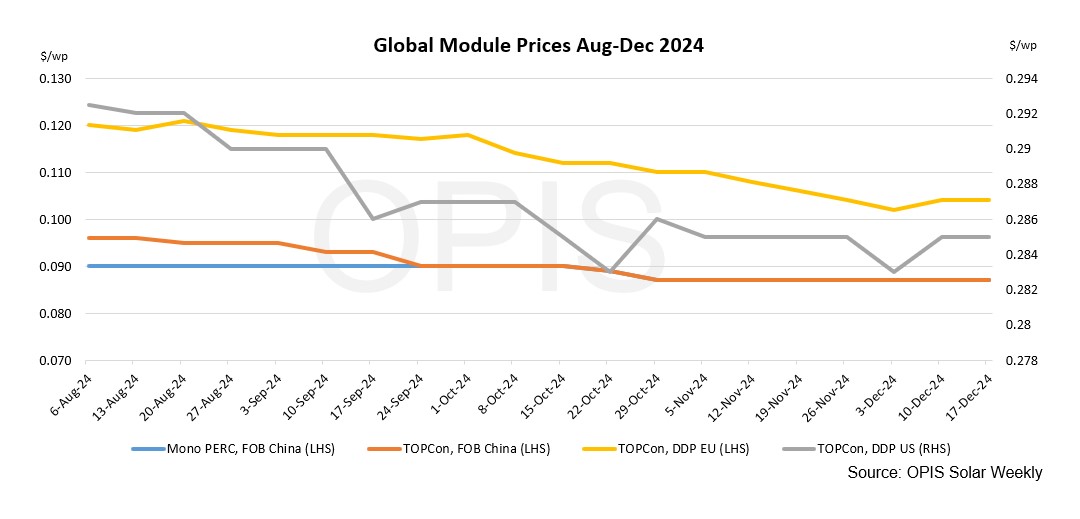

The Chinese Module Marker (CMM), OPIS’s benchmark for TOPCon module prices, remained steady this week at $0.087/W Free-On-Board (FOB) China. Price indications ranged between $0.083/W and $0.095/W.

The Chinese solar module market is grappling with the effects of a recently signed “self-regulation agreement” by over 30 leading solar companies. This initiative aims to stabilize prices by controlling supply. However, weak demand continues to weigh on the market.

“Most manufacturers are operating at 50-70% capacity, down from 80% last year,” a producer commented. Despite efforts to regulate production, price recovery remains elusive. A top-five module producer noted that persistent sales pressure and high inventory levels are likely to cap price increases through at least mid-2025.

DDP Europe

European prices for TOPCon modules saw a modest 1% increase, with the average price assessed at €0.099/W ($0.102/W). Price indications ranged from €0.075/W to €0.115/W for Tier 1 panels.

Market sources attribute this slight rise to expectations of improved demand by late December, though the market has struggled with sluggish sales and aggressive selloffs in recent months. Freight rates from the China/East Asia-North Europe Ocean route dropped by 5.13%, settling at $5,051 per forty-foot equivalent unit (FEU), equivalent to $0.00126/W.

DDP U.S.

U.S. module prices remained stable, with TOPCon modules for utility-scale projects assessed at $0.285/W. Forward prices for Q1 2025 delivery are slightly higher, at $0.293/W, while Mono PERC modules for the same period are priced at $0.282/W.

Developers are rushing to secure inventory before year-end to ensure eligibility for the Investment Tax Credit (ITC) amid fears of potential changes under the incoming Trump administration. A distributor emphasized that any new orders must be delivered within 3.5 months to meet safe harbor requirements.

The market is still reacting to the U.S. Department of Commerce's (DOC) late-November preliminary determination on anti-dumping duties. Some suppliers impacted by the high cash deposit rates are quoting as high as $0.41/W for Q1 2025 delivery. While price increases from non-subject countries like Indonesia and Laos have been minimal, some sources remain skeptical about sustained price hikes.

“Given the existing operational capacity outside the affected regions, including the U.S., and plans for new cell factories, the impact may be short-lived,” one developer observed.

|